Computing tax on item cost instead of price

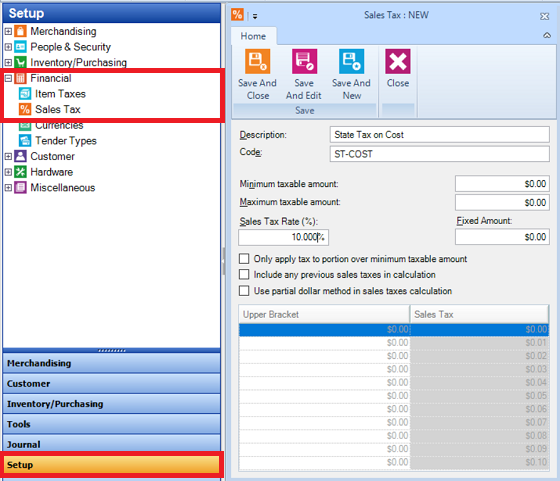

| 1. | Set up a Sales Tax type based on cost:

|

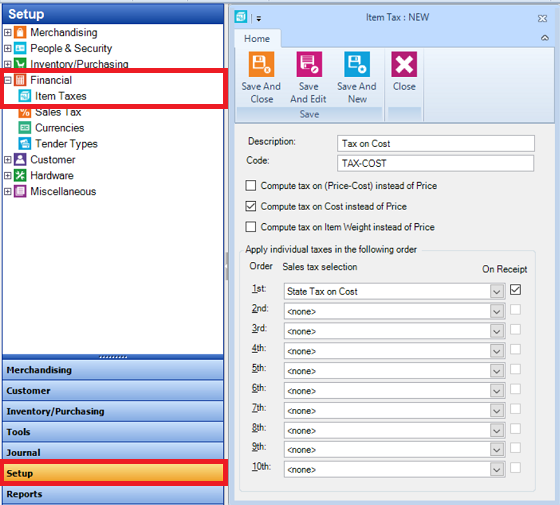

| 2. | Set up an Item Tax type based on cost:

|

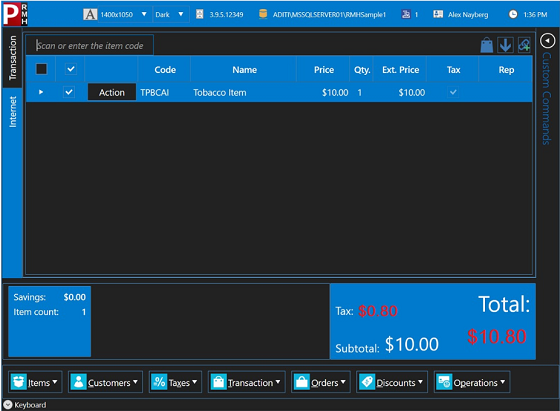

| 3. | Set up an item so that POS computes tax on the item's cost:

|